Open HRMS GOSI Contribution Module

Open HRMS is a complete suite of management application for efficiently and effectively managing one’s human resource. It has all the robust features that are inevitable and crucial of looking after and managing the internal and external human resource functions.

This blog discusses Open HRMS GOSI Contribution module.

Open HRMS Saudi GOSI Contribution is constructed for the organizations in Saudi Arabia. GOSI is a Saudi Arabian government agency concerned with social insurance in the country. This module handles the GOSI contributions from the Saudi employees and employers in Saudi Arabia.

Basically, the GOSI contribution is only applicable to Saudi citizens and who are in the age group between 18 and 60. This module helps to create GOSI contributions in the salary payment by satisfying the conditions of the GOSI contributions.

Features:

> Created separated salary structures for Saudi citizens and overseas peoples.

> Added payslip lines for employee contribution and company contribution.

> Provides pdf reports for two new contribution registers that are “GOSI Company Contribution” and “GOSI Employee Contribution”.

GOSI Calculation:

> Employee Contribution

GOSI Amount = 9% of Basic + HRA

> Employer Contribution

GOSI Amount= 11% of Basic + HRA

Configuration:

> Install module ‘Open HRMS Saudi GOSI Contribution’ from odoo app store.

> Place it in your custom addon folder.

> And run it in a private window.

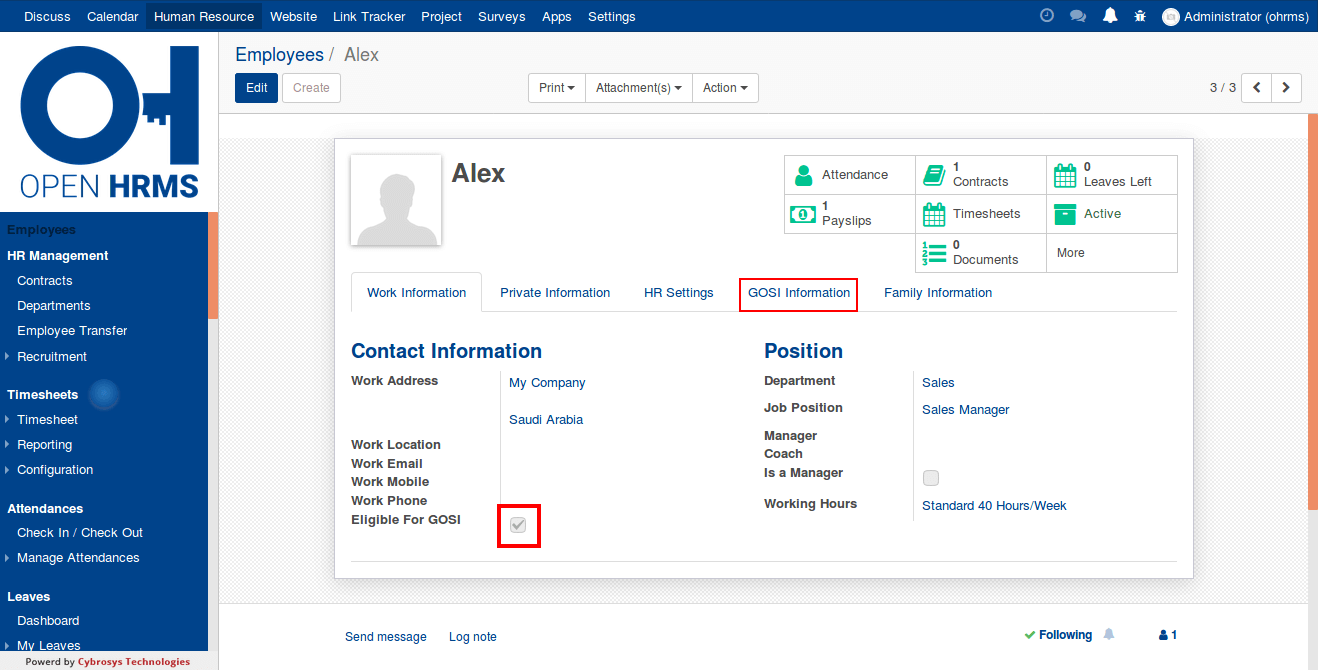

Checking Eligibility of the employee for contributing to GOSI

> In order to create GOSI details for employees, firstly the employee should satisfy the age limit condition. If he satisfies, the employee form will open as below.

GOSI Informations

> Now select the “GOSI Information” menu to fill the GOSI details.

Type: Which specifies the type of the GOSI, here we choose ‘Saudi’.

GOSI Number: The unique GOSI number provided to the employee.

Issued Date: The date in which GOSI Number is issued.

Defining Contract and Salary Structure

> After that click on the ‘Contracts’ in the Employee form and then create a new one and while selecting the ‘Salary Structure’ choose that according to the ‘Nationality’ of the employee.

Creating GOSI Register entry of the employee

> Then we have to register this employee with his/her GOSI details. To initiate the action, select the menu ‘GOSI Register’ and just choose the employee and save it

Creating Payslip to the employee

> Next we have to create the payslip to the employee for that click on the menu ‘Payroll’ and click ‘Create’ to make a new one and then choose the employee in the ‘Employee’ field and click on the button ‘Compute Sheet’.

Here we can see that two new payslip line entries are created which are ‘GOSI Contribution For Saudi Employee’ and ‘GOSI Company Contribution For Saudi Employee’.

Printing report of ‘GOSI Contribution For Saudi Employee’

> Now we can print the PDF reports of the ‘Contribution Registers’ for that go to ‘Configuration’ menu and then select ‘Contribution Register’

> For printing ‘GOSI Contribution For Saudi Employee’

And the report will be printed as: