How to Choose the Right Payroll Processing System?

Employees are the soul of an organization. It is the happy workforce that keeps an organization running. And what makes a happy workforce is the satisfying amount of remuneration they earn from their workplace in return of their work done.

Yes! am speaking on the payroll-the largest expense incurred by a company or an organization. It is the payroll that is the first lookout of a candidate when he searches for a job. In fact, it is the element that retains an employee in the company for long period of time.

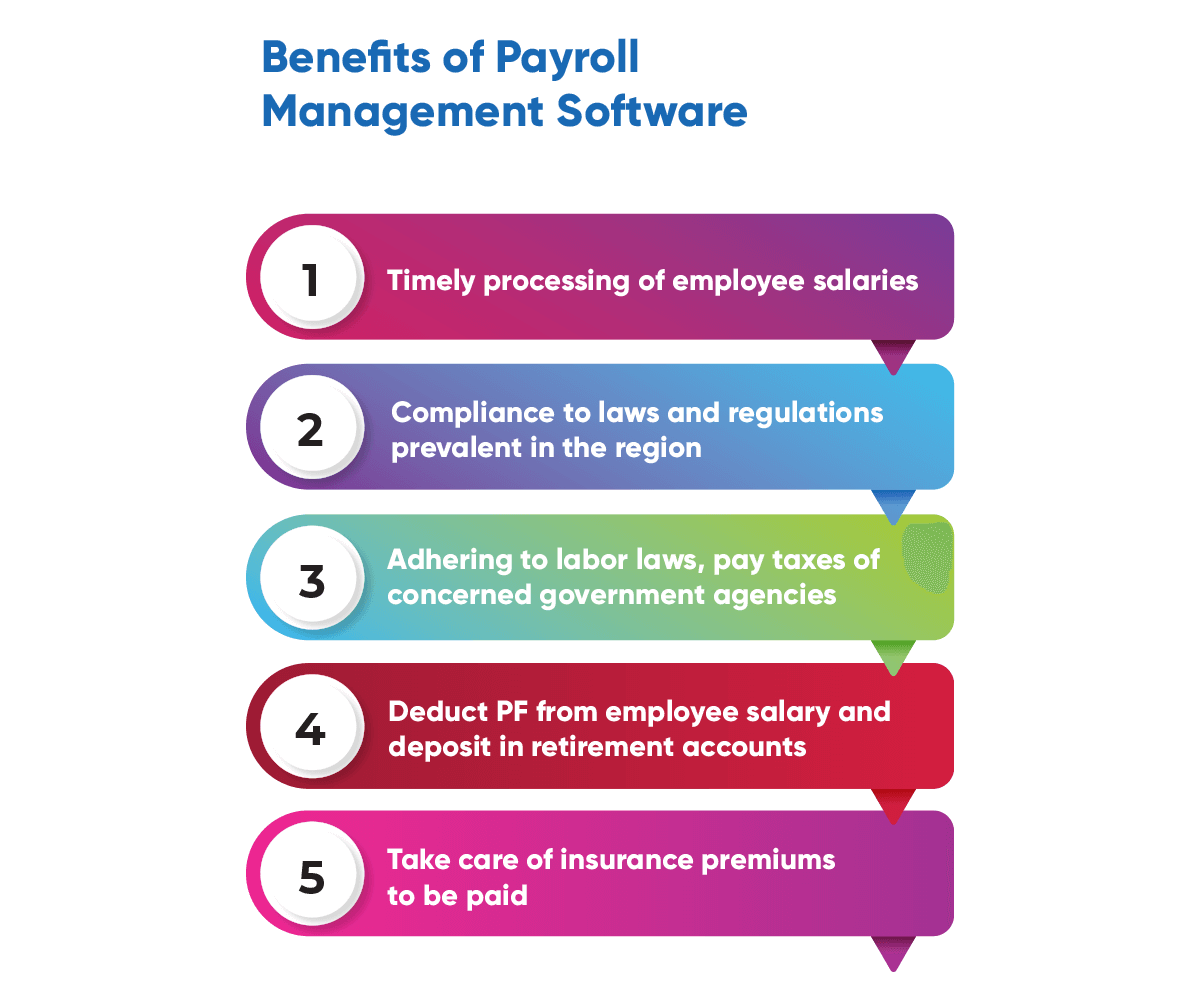

Thus being a salient feature for the working of an organization, payroll management has to be taken utmost attention in the business place. Whether you are running a mid-level business or large enterprise, the employees have to be given off with their rights at right time.

Generating a pay slip may seem an easy straightforward process, however there runs multiple things behind the curtain that ensures the generated pay slips are error-free and accurate. In case if your workforce size is 6 or 10, say a countable number, it obviously comes handy and much easy for the company to hand-out money to an employee in the month end.

But with rising number of workforce, that too with different packages, payroll management becomes highly challenging giving much strain to the concerned departments. Things will really turn bad if there isn’t an automation brought into employee payroll management.

One needs to take care of different regions say the attendance, leaves, employee workhours, timesheet entries, bank accounts, taxes to the mix for fixing employee payroll. Unlike the earlier, mere spreadsheets cannot do the magic in calculating employee pay. Only a robust payroll management software can do the necessary, taking care of entire process from start to finish.

What is the role of payroll system at your workplace?

Be it the hourly payment or monthly payment, a payroll system in place, well do the job taking care of employee workhours, attendance, deductions, pay rates and other conditions. They automate the payroll process, taking into action all conditions and policies set by the organization. It can either act as a standalone application or come as a part of integrated HR software, fulfilling every human resource need.

When payroll management system comes as part of an integrated human resource management application, it has several benefits to offer with. First and foremost, is totally eliminates the need of manual input of employee data required for payroll calculation. Being integrated, the payroll system can automatically deduct the data from the system needed for calculating the employee wage for the month. Be it the attendance records, timesheet data or loan deductions. Without much manual intervention, everything gets sorted internally. You need not live on the lengthy and complex spreadsheets to dissect each and every bit of data. Every applicable deductions and additions are automated in pay by payroll systems reducing chances of errors and mistakes.

Payroll management system can indeed be a critical pillar that holds your business from falling down. Because, any failure in fulfilling the payroll efficiently can lead to complete failure of the company.

Having a payroll software in place can be highly appealing and imperative as it reduces the chances of mistakes and misrepresentation. Many times, the organizations are subjected to face legal issues for not complying to the labor laws or employee regulations of the nation. Often this paves way to company paying hefty fines or compensations, following the huge legal and financial ramifications. This can consecutively lead to the collapse of an organization. However, implementing a payroll system at your workplace, can free you from all these worries as it strictly adheres to regional laws and regulations.

Open HRMS is a complete human resource management application built on the platform of open source ERP. In order to avoid the above said hassles and save the organizations from its disastrous consequences, Open HRMS have made the application specifically suitable for GCC countries and US nations.

Right from timely processing to employee payroll, to maintaining and tracking of various employee data for their payroll calculation, Open HRMS has all that features demanding to perform the action. One can easily get with customized reports generating real-time insight of various elements in the business. Open HRMS eliminates the need of any manual data compilation associated to payroll calculation.

Checklists of a Good Payroll System

Having a payroll system at your workplace many not bring the anticipated results. However, via choosing a right payroll management software can bring in all the changes such as easy and error-free payroll processing. Here is the checklist that defines what make a payroll software good and self-sufficient.

Have a look:

- Complete automation of task, bothering least intervention of humans.

- Real-time, cloud-based payroll processing, making globally accessible.

- Easily configurable platform for easy modifications to be made.

- Cutting-edge data encryption assuring utmost data privacy and security.

- Customizable salary structures.

- Multiple salary structures and pay packages for same pay slab.

- Integration with the attendance management system.

- Integration with the leave management system.

- Integration with timesheet management system.

- Accurate salary computation with a guided checklist.

- Automated calculation of reimbursements, bonuses, and loans.

- Comprehensive database for maintaining and tracking payroll records.

- Compliance with labor laws and regulations.

- Calculation of employee benefits like PF, ESI and TDS.

- Labor welfare fund calculations.

- Digitally signed and generated taxation forms.

- Automatic generation and distribution of customized pay slips.

- Automatic disbursements of salaries.

- Customized reports for business analytics and insights.

- Simple interface for easy management.

- Messages/Emails notifying employees about payroll updates.