Giving a loan to an employee is comparable to providing financial help. It occasionally resembles a wage advance. However, the biggest benefit is that an employee receives a large sum of money all at once to cover their necessities. They can also choose to repay the money in whole rather than in installments, which improves the employee's financial security with the aid of his company, and which also makes the employee more accountable to the company.

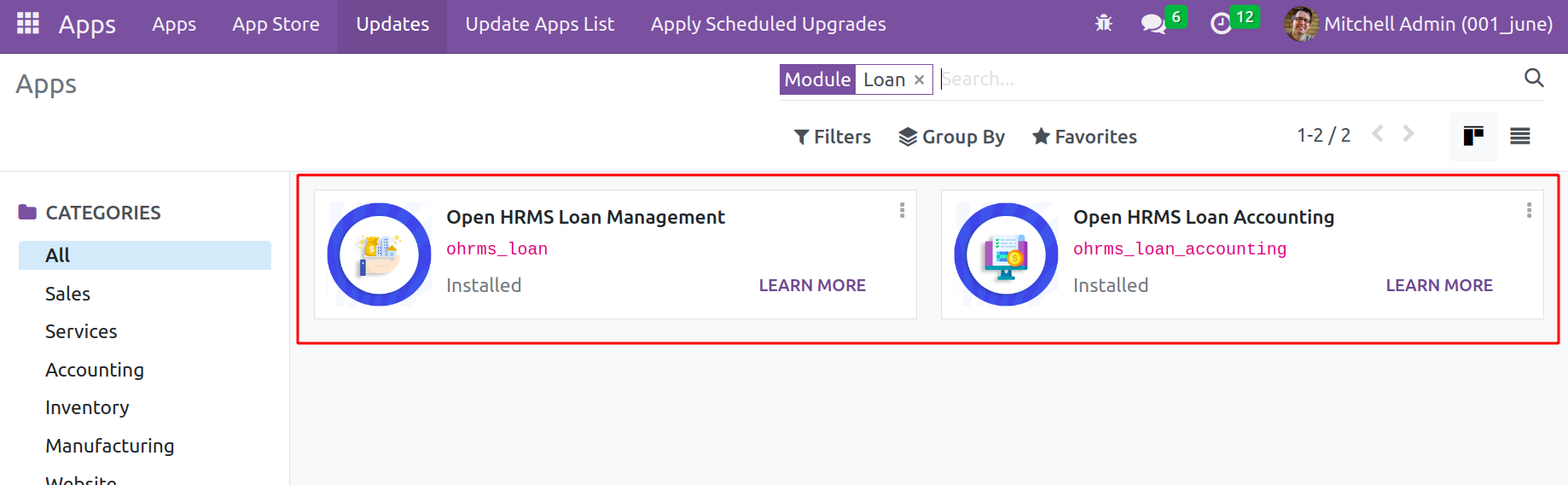

Odoo16's open-source HRMS makes it simple for the business to manage employee loans. Odoo introduced two modules—Loan Management and Loan Accounting—for that purpose. These modules make it simple for employees to obtain loans and calculate their monthly payments. The accountable party can quickly assess the request and distribute the funds. The fund can effortlessly deduct an installment from an employee's pay stub. The user is able to manage loan accounting with ease.

The Loan Management module is offered by the OpenHRMS platform. Install the module and view it in the database. Once this module is installed, the OpenHRMS Employees module in the platform will show features for loan management.

Let's check about the features of the Loan Management module in this chapter.

Loan Management

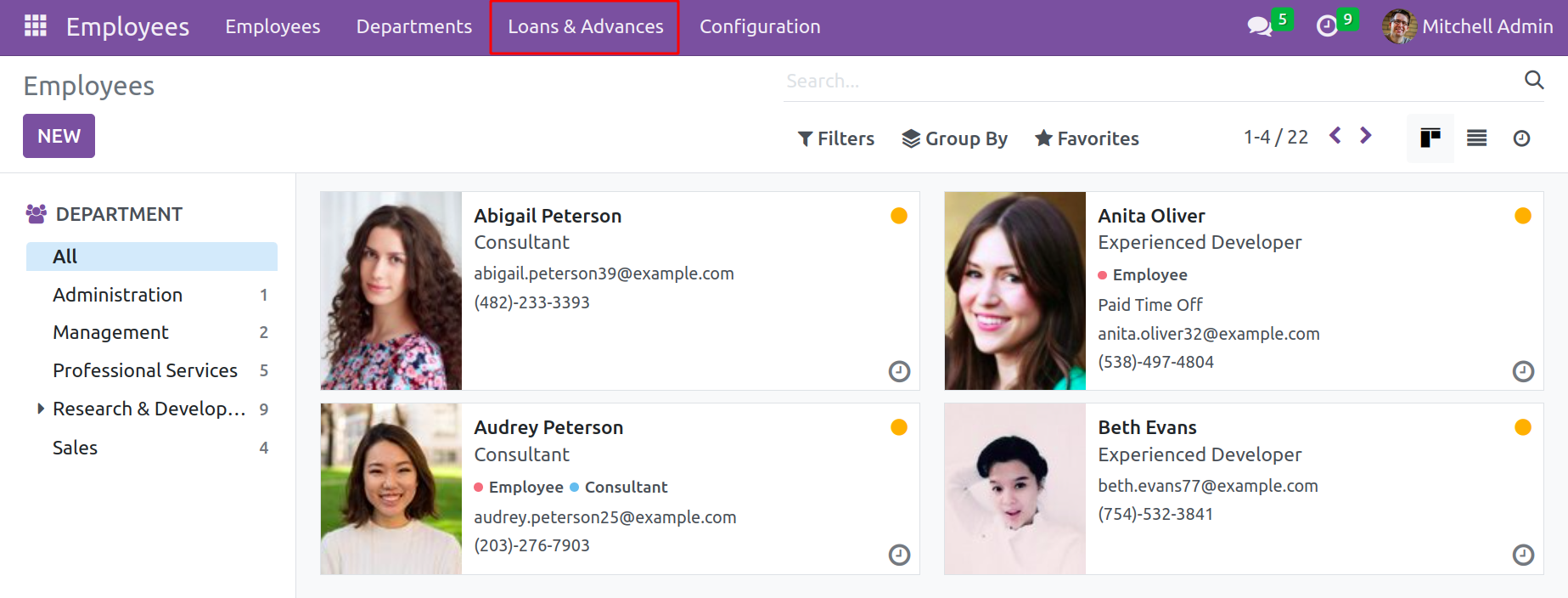

The OpenHRMS suite's loan management system allows for the configuration of different loan policies. These lending policies may then be delegated to the necessary staff. When the Employee module is opened once the Loan Management module has been installed, the user can see the Loans area, as illustrated in the figure below.

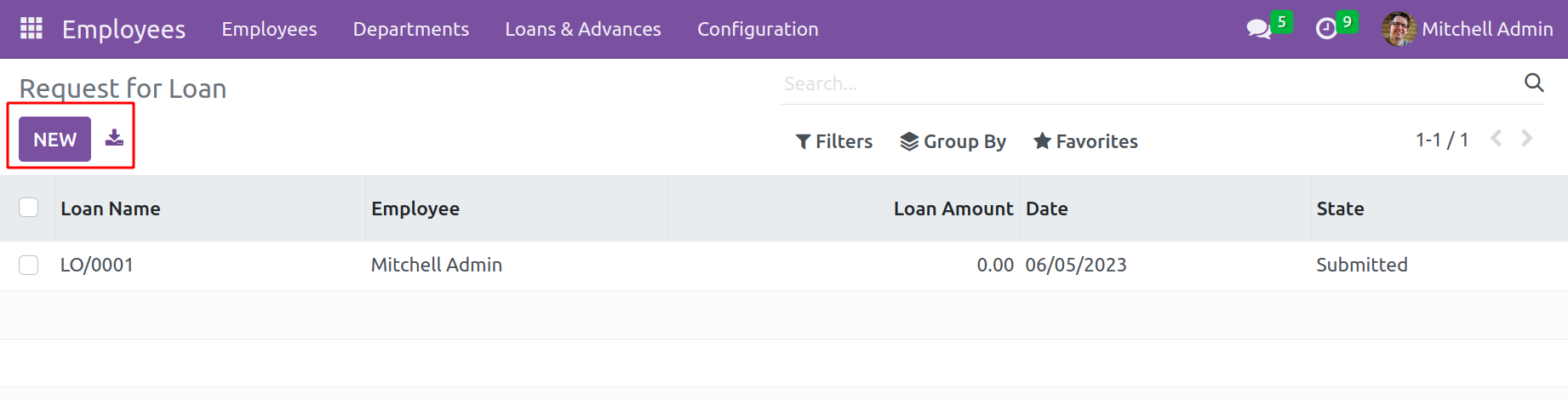

View the Request for Loan option under the Loans and Advances section's Loan heading here. This option allows one to control loan requests. When you click the Request for Loan button, the Request for Loan window will open and display the previously described loan requests along with the Loan Name, Employee, Loan Amount, Date, and State.

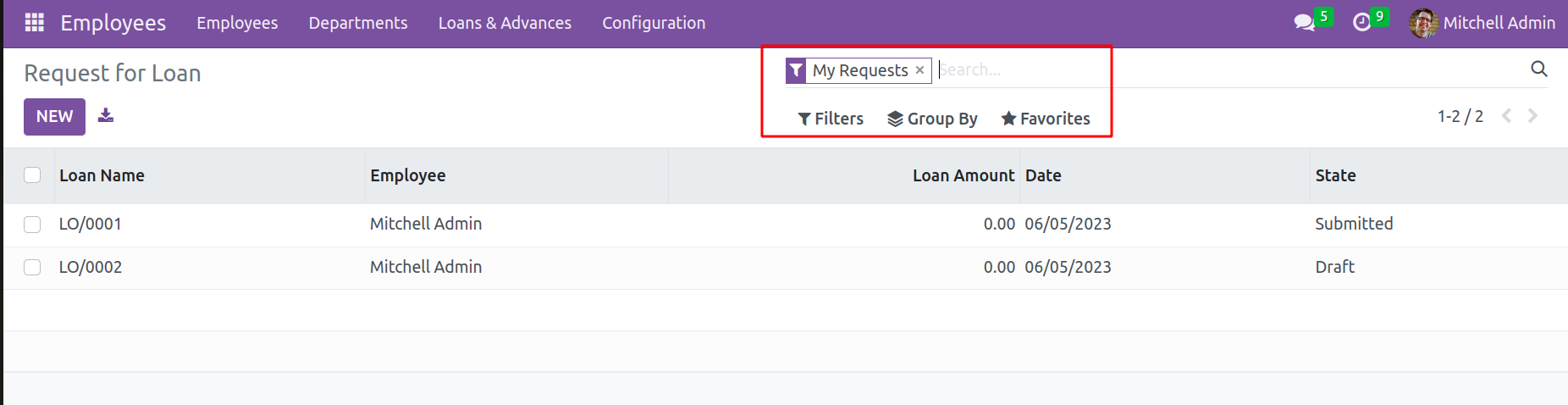

Applying various filters and grouping options in the window enables users to manage the requests according to various standards. The 'My Requests' default filter can be found here in the Filters tab. Similarly, classify the requests using the default Group By options, which include Employees, Departments, and Status. Click on the Create button located in the top left corner of the window if the user wants to create a new Request for Loan.

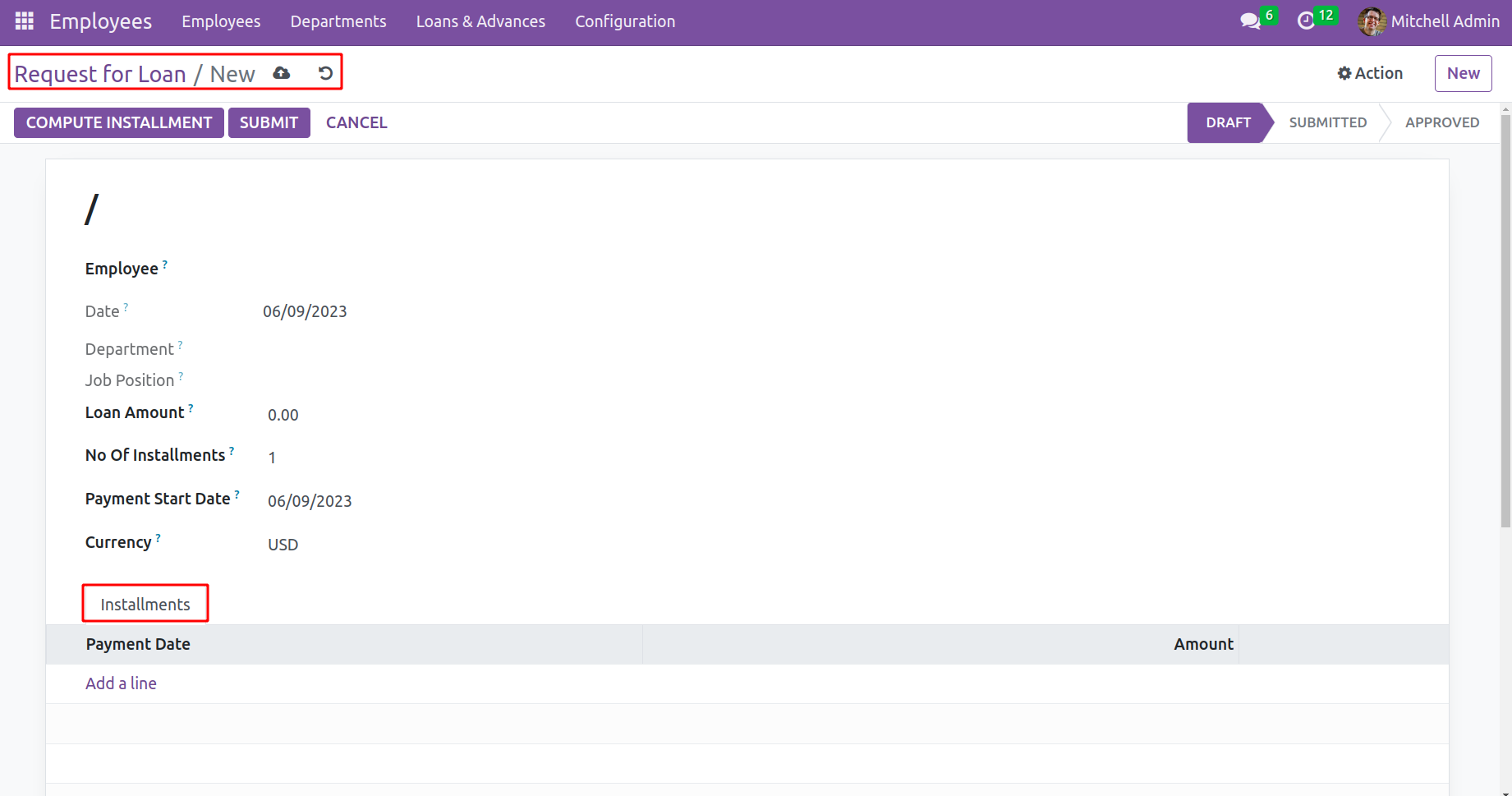

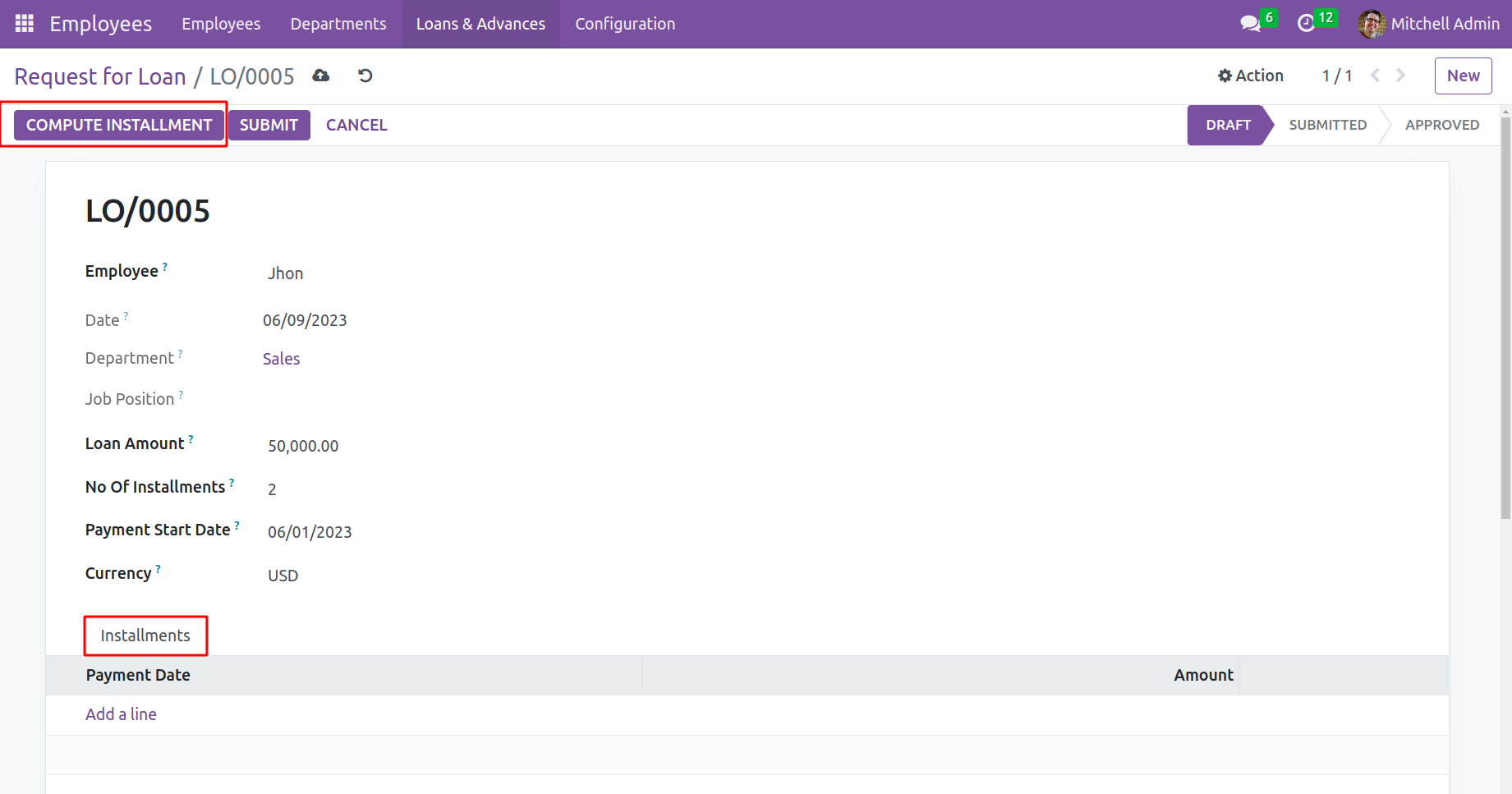

As seen in the screenshot below, it will now enter a loan request creation form. When the employee name is added, if this particular employee's details are already saved in the system, the Department of the employee and Job Position will be automatically filled. Then the loan amount and number of installments can be added. The payment start date and currency can be mentioned here.

Add the employee details who receives a loan from the company. Click the Save option to save the information after determining whether to enter the employee's name, the loan amount, and the number of installments. The Installments tab contains a description of the installment computations. Once it has been verified, click the Compute Installment button, which is highlighted in the below image.

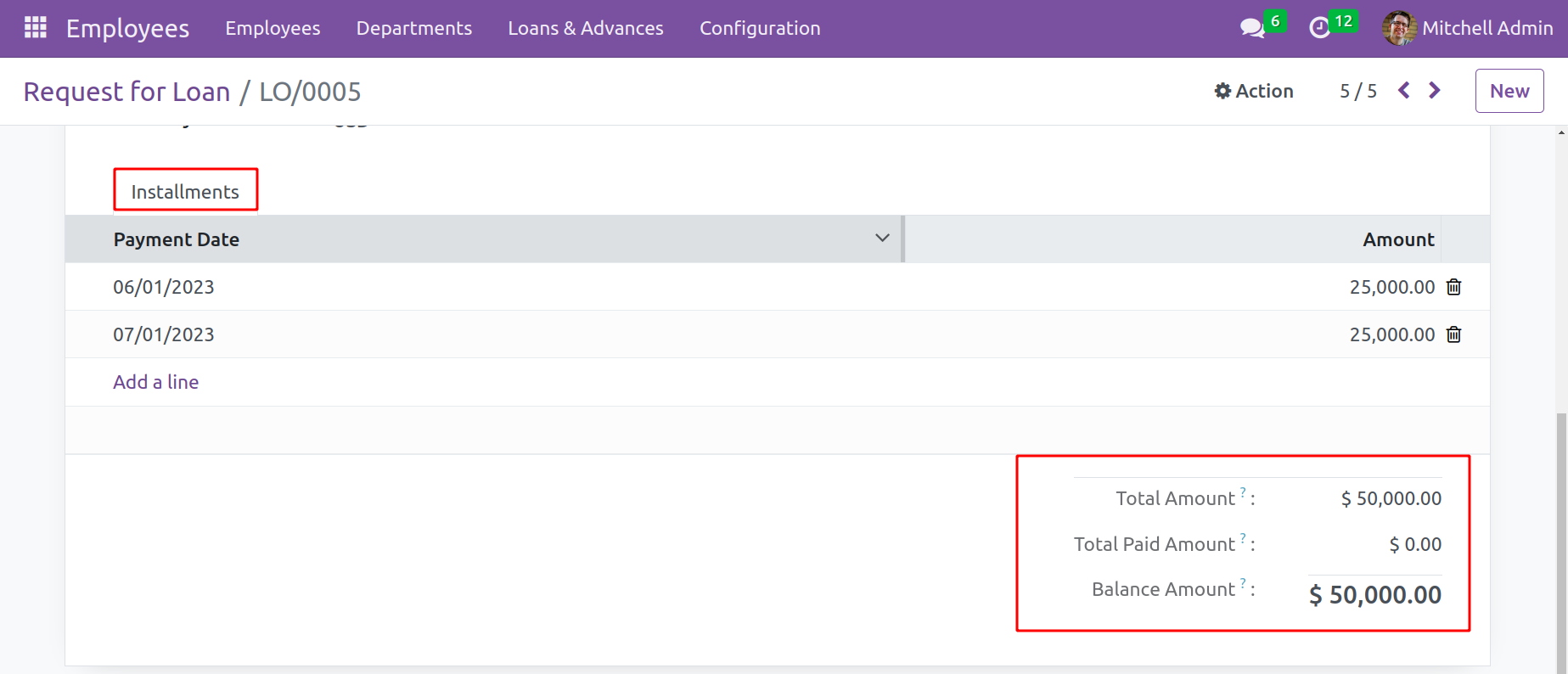

For the Installments field to be filled out automatically, after clicking on the Compute Installments button. One can use the Submit button to send the loan request to the appropriate authorities after creating the installment lines.

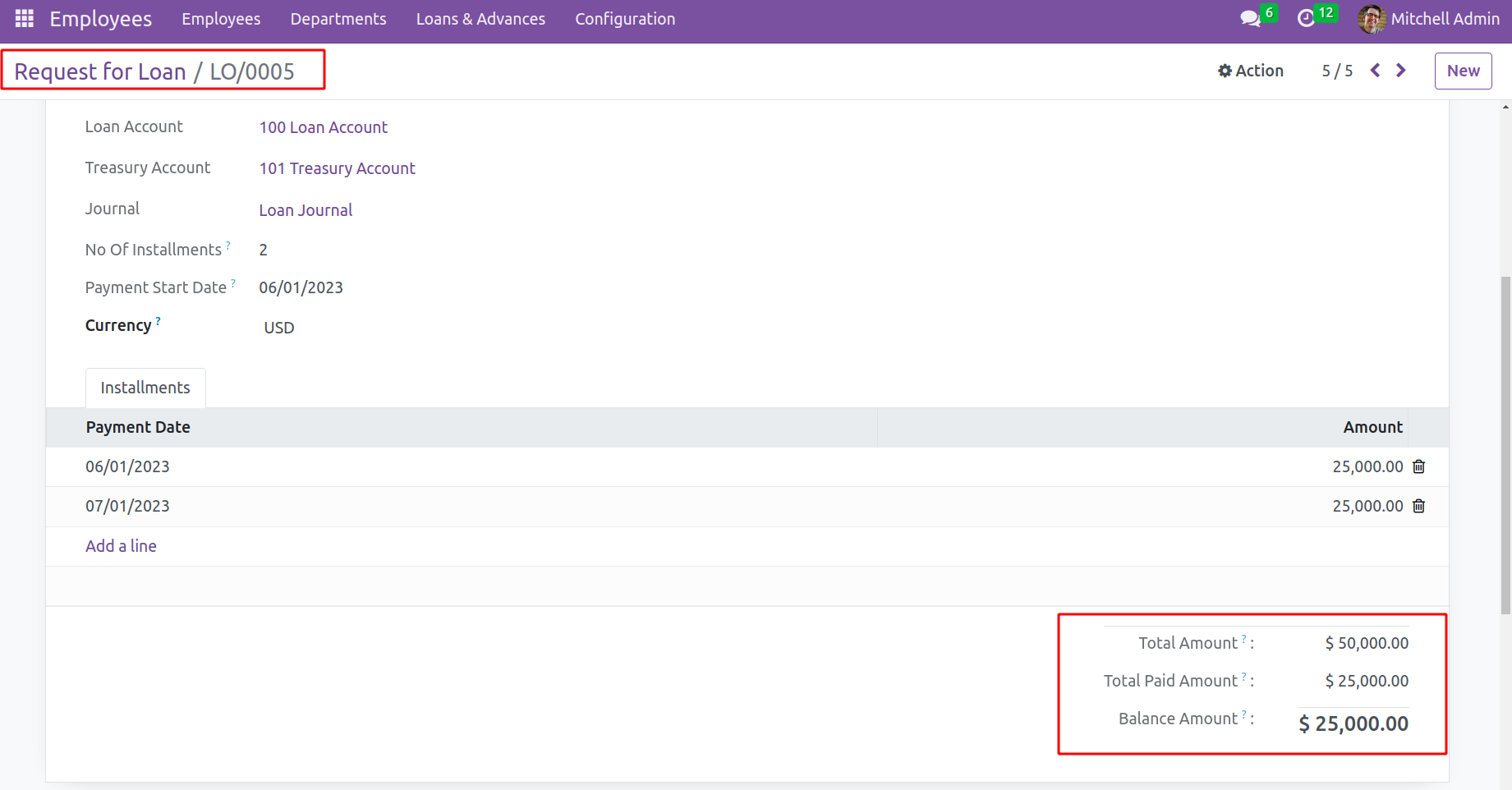

There also shows the Total Amount, Total Paid Amount, and Balance Amount of the loan.

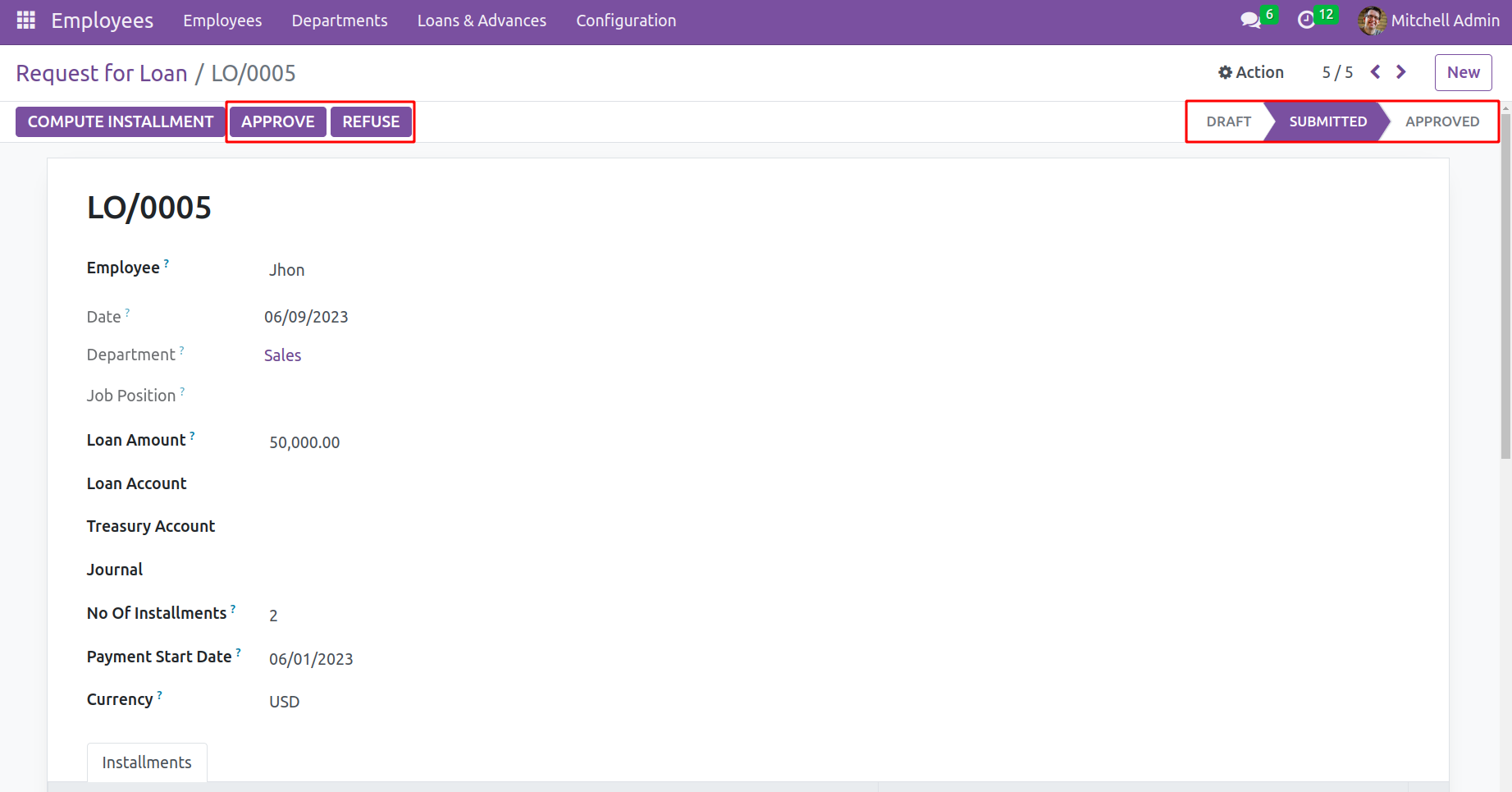

The appropriate authority may review the supplied record and, following cross-checking, may authorize it. They may also refuse if any errors or unacceptable results are discovered. On the upper right side of the window, the relevant request status is also shown.

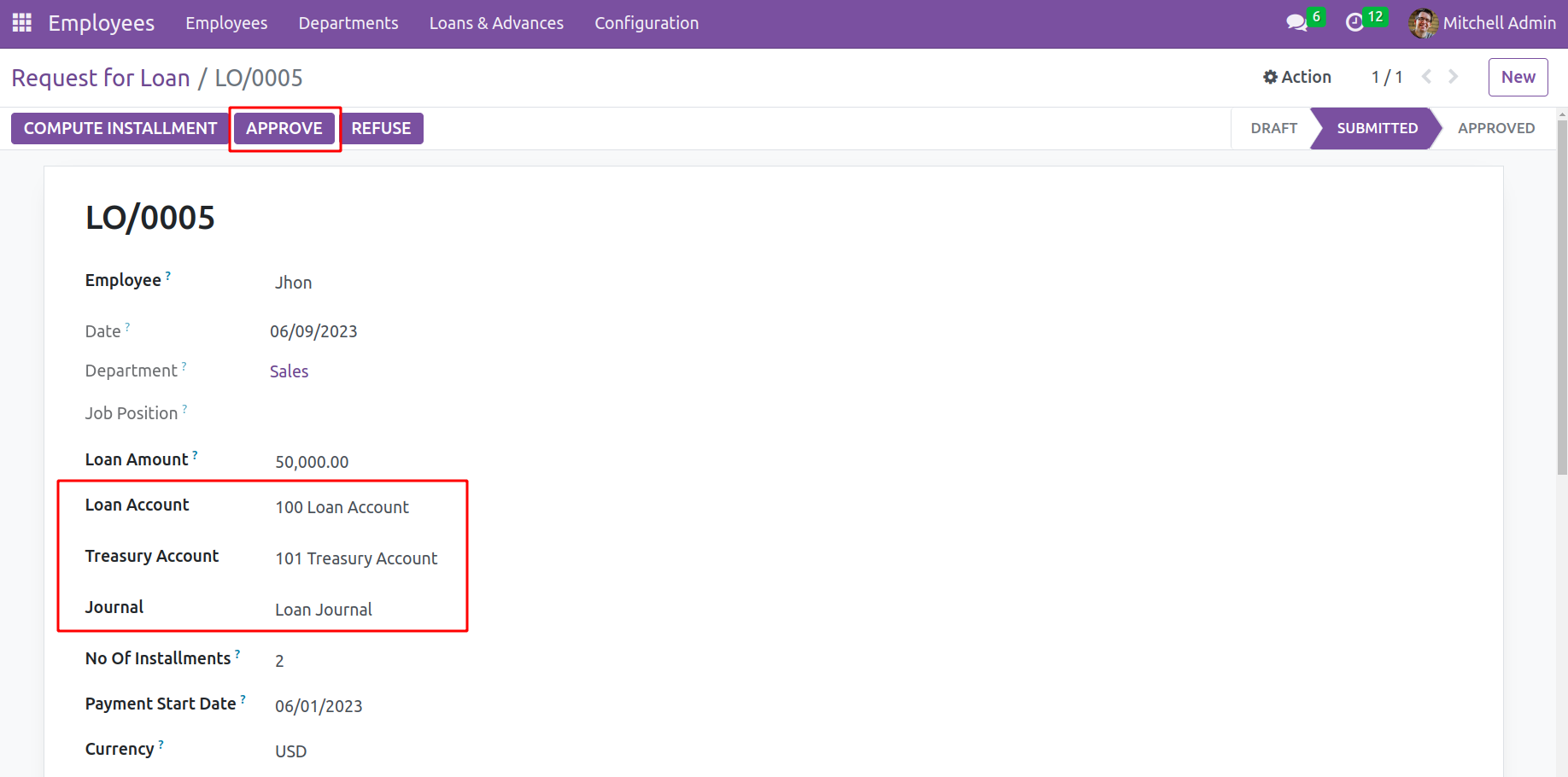

Two more fields will be shown inside the form; they are labeled ‘Journal’, ‘Loan Account’, and ‘Treasury Account’. These Accounts can only indicate loans if the system has a Loan Accounting module installed. Before authorizing it, include the Account details. The request's status will change from Submitted to Approved if it is granted.

The OpenHRMS Employees module handles loan requests from employees in this manner.

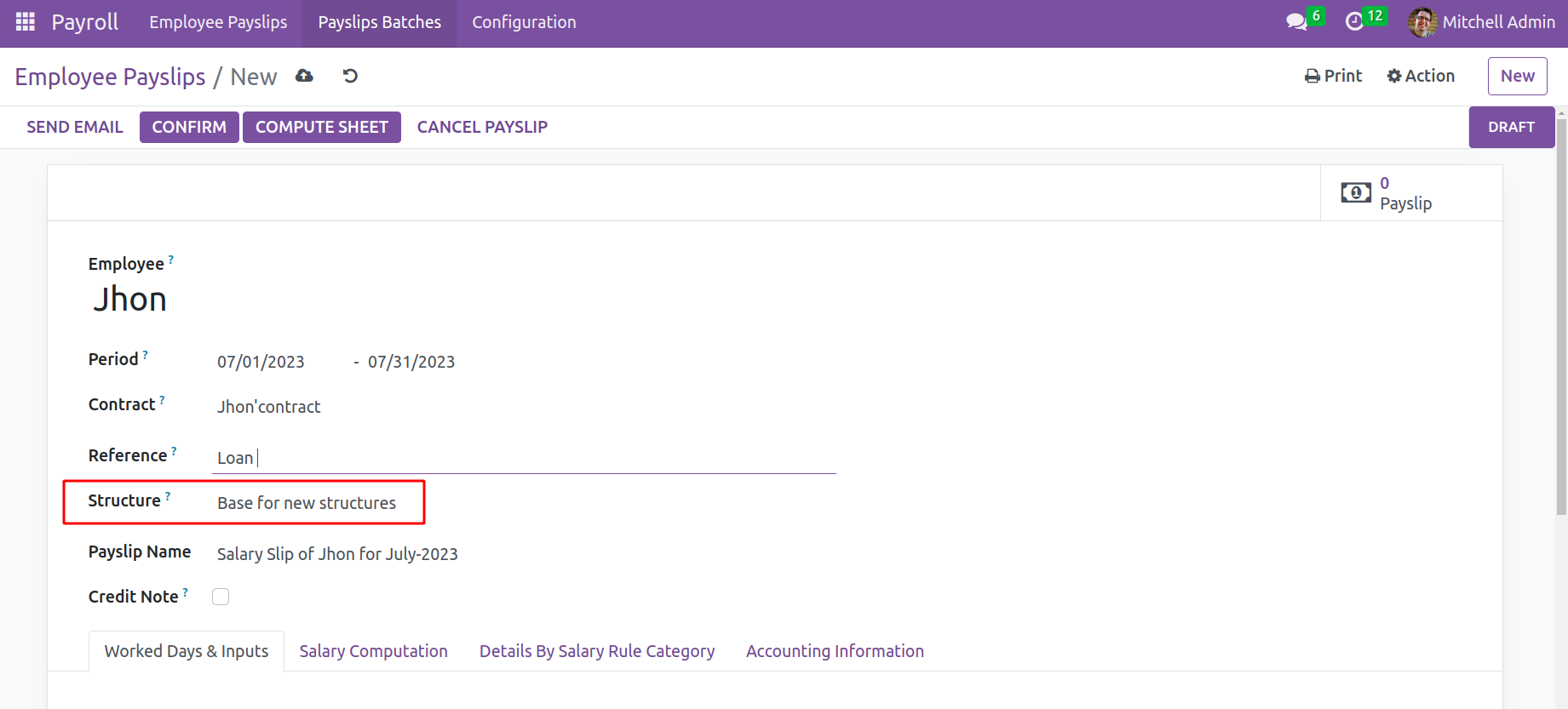

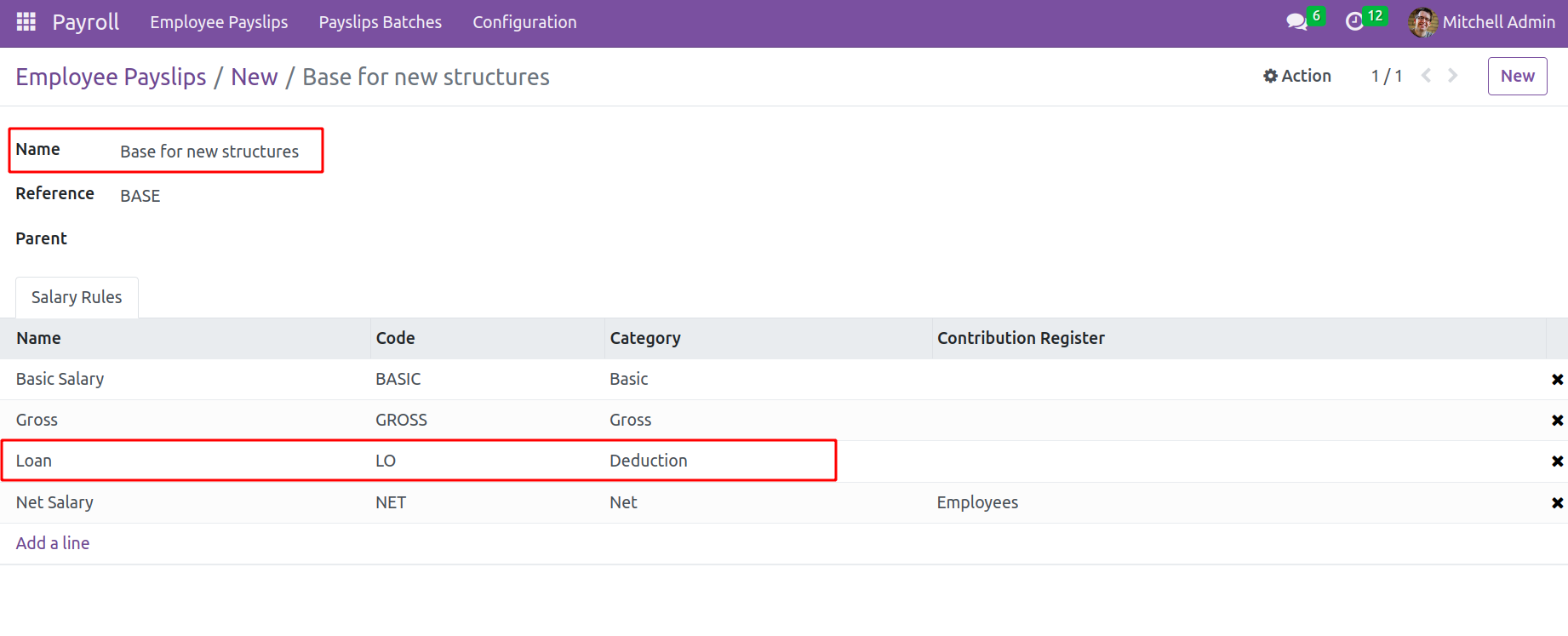

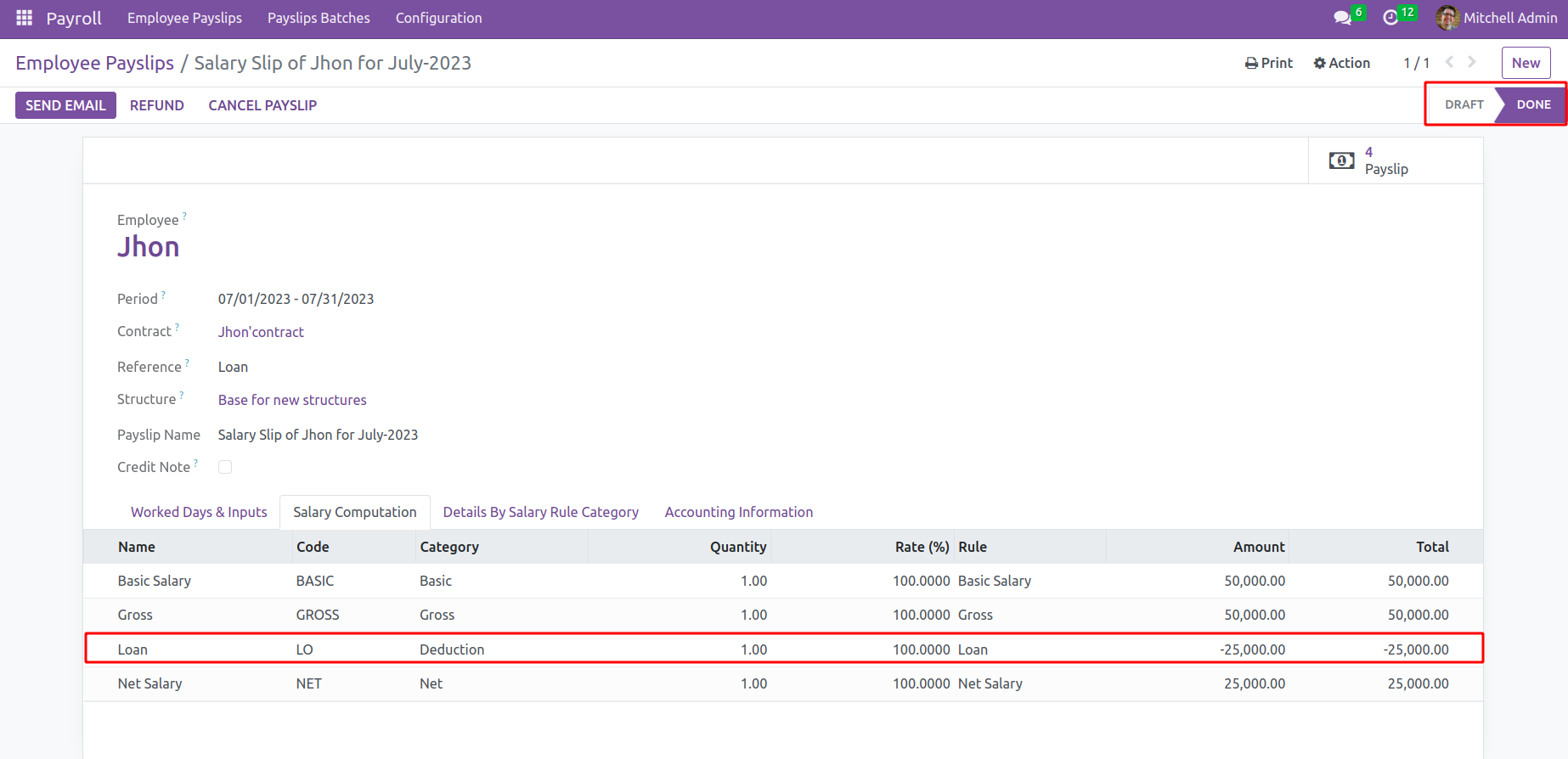

Let's look at the Payroll module to better grasp the operational aspect of the module. Create a payslip for the employee using the payroll module; the payslip will reflect the loan amount that will be withdrawn from the employee's pay. Before approving the payslip, make sure the salary rule for the loan is set up within the compensation structure. Open the Salary Structure as a result.

A rule with the name Loan can be found inside the structure. It is set up as a deduction and takes the chosen loan amount out of the employee's salary.it is a system-preconfigured one.

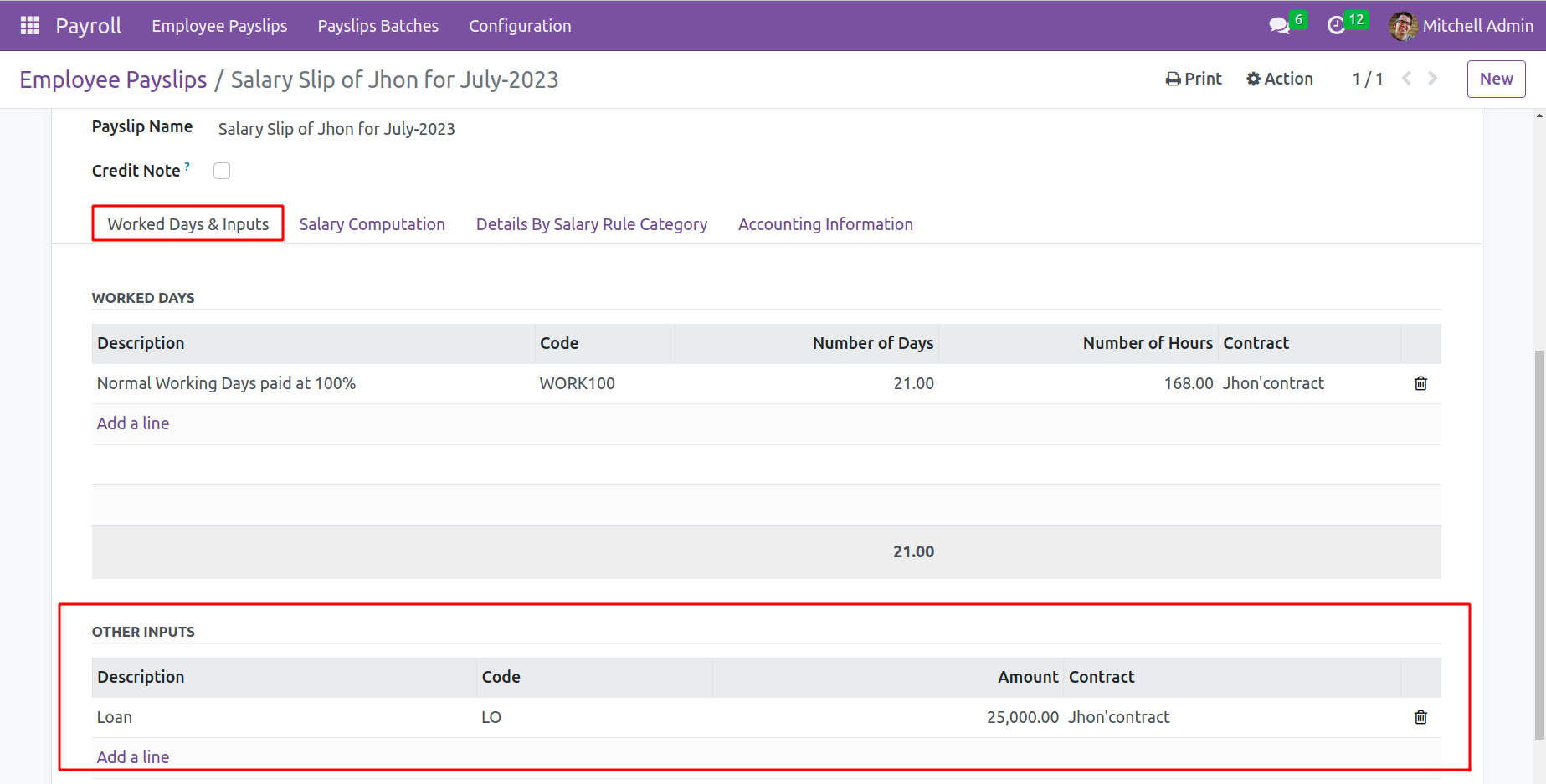

Returning to the payslip, let's. The Loan is added as an Input on the Payslip's Worked Days and Input tabs, respectively.

Then click the Compute Sheet button to determine the employee's pay slip. The employee's computed payment can be viewed in the Salary Computation tab. Confirm the payslip by clicking the Confirm button to finish the procedure.

From the salary computation tab, it's clear that the Loans first installment is deducted from the salary. When moving back to the created loan request, inside the installment tabs, check under the rightmost side the first installment is shown as deduced from the total amount. Each time the employee payslip confirmed the amount deducted until the value became zero.

Loan Accounting

Loan management now has an extra feature because of the loan accounting module. Or else we can say that it gave the accounts manager more authority. Although the loan arrangement benefits the employees, it can sometimes become problematic. A cost to the company to lower the risk of managing loans Approval from the Accounting Department is a new factor that loan accounting introduced.

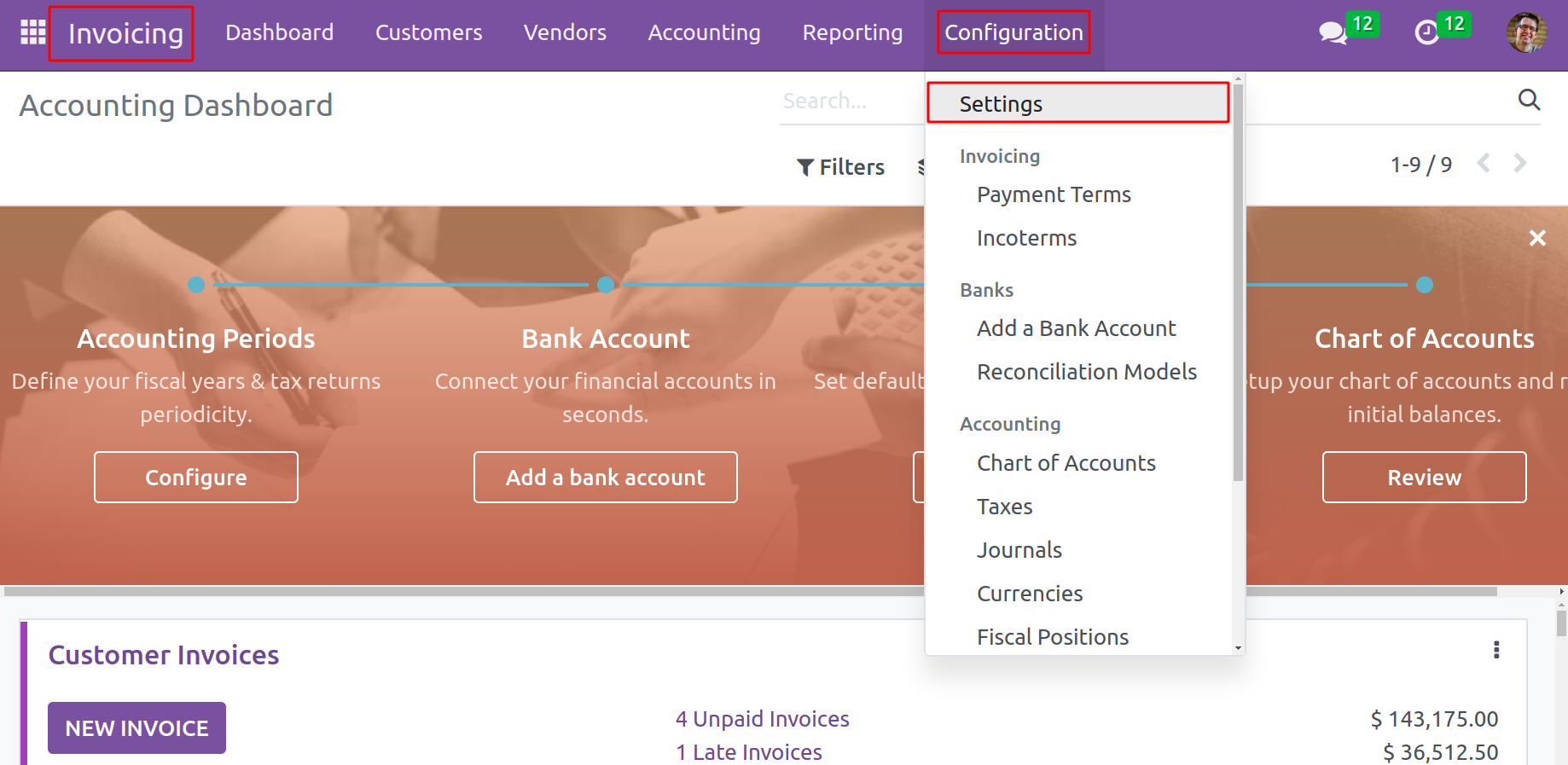

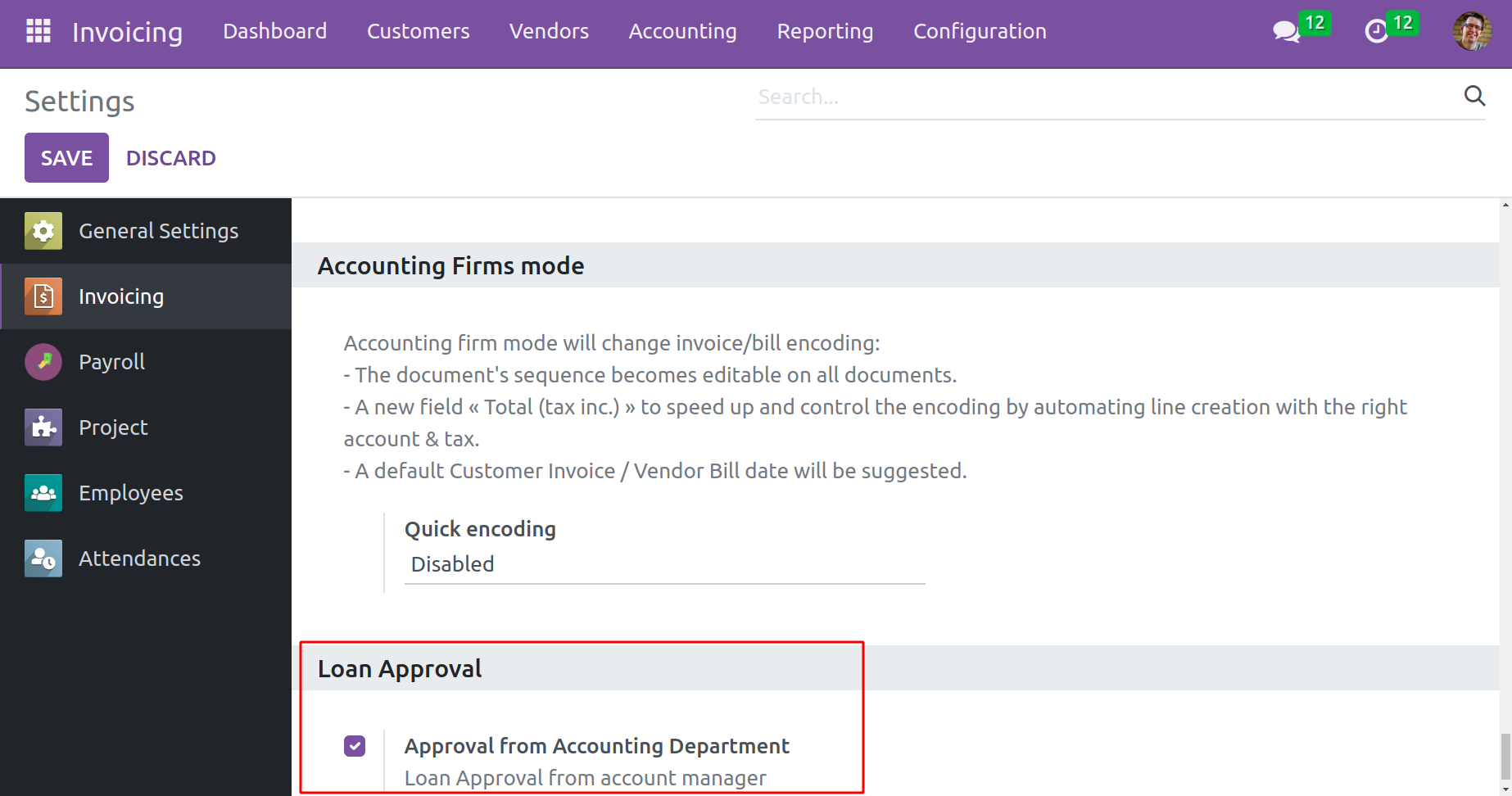

The Loan Approval feature can be discovered while looking at the Settings option in the Configuration tab of the Invoicing module.

Under this Loan Approval, there is a feature ‘Approval from Accounting Department’ which will add an approval stage for employee loans from the accounts manager. Once the checkbox is selected and this configuration is saved.

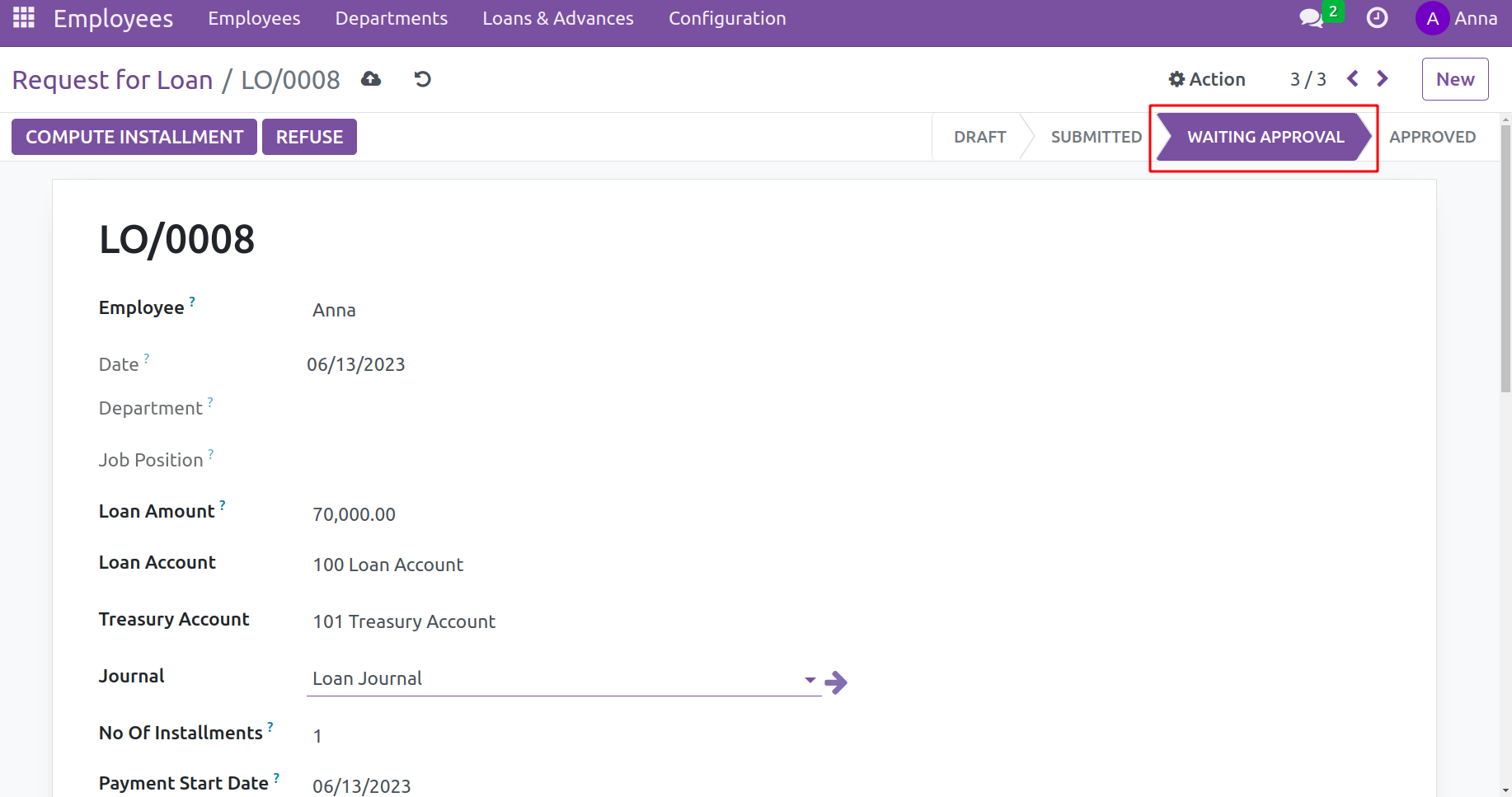

If the above option is chosen and as per normal, the user can create a loan request; however, it requires accounts manager approval. This denotes that a loan request can only be approved by the management. After hitting the Submit button on a loan request created by an employee, the request proceeded to the Waiting for Approval stage. Only once the request has been authorized by a designated individual will it move to the approved stage. Check it out.

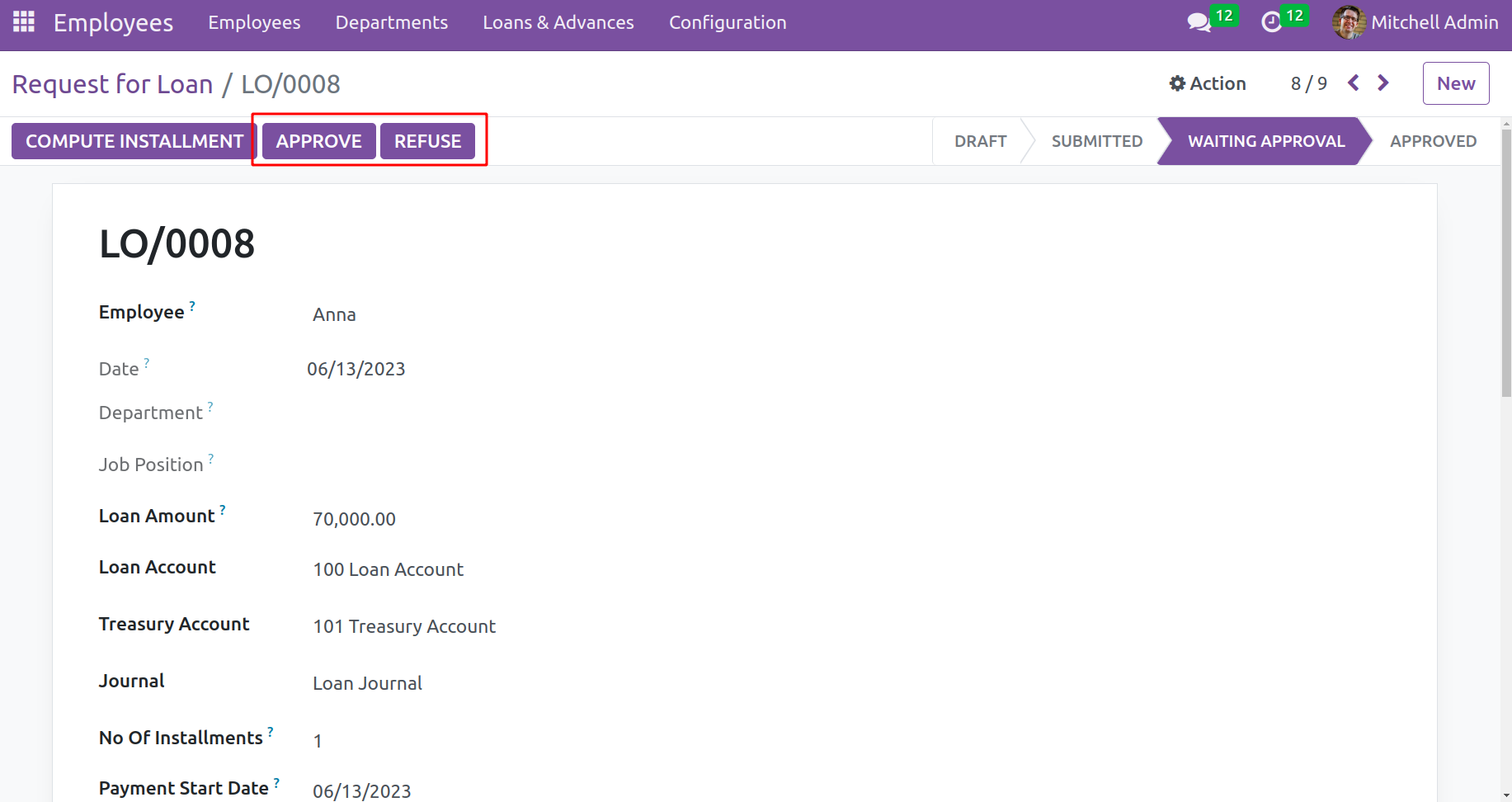

The list of loan requests appears when the admin logs in. The administrator can accept or reject the request while it is waiting at the ‘Approval’ stage. If the request is approved by the admin, the previously described process can continue.

Before Approving the loan request, the user must submit the accounting information, such as the journal, loan account, and treasury account, if it is not given. These details must be added before the form can be authorized by the authority. Only after implementing the Loan Accounting module is this accessible.

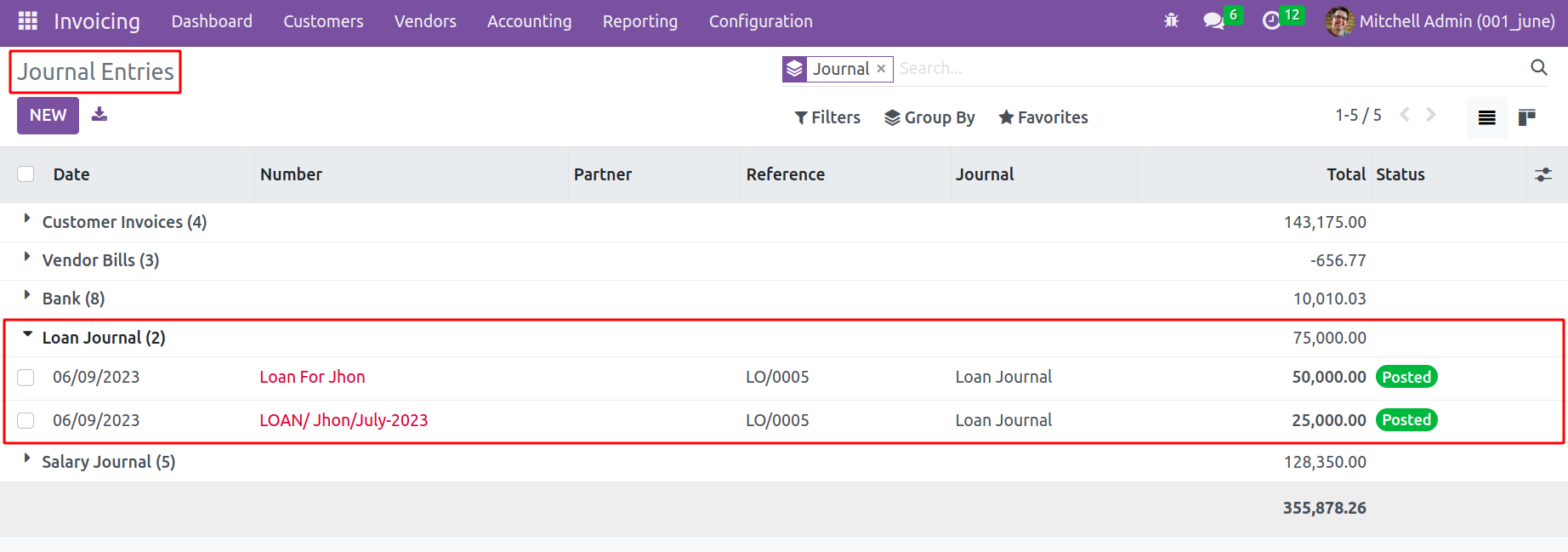

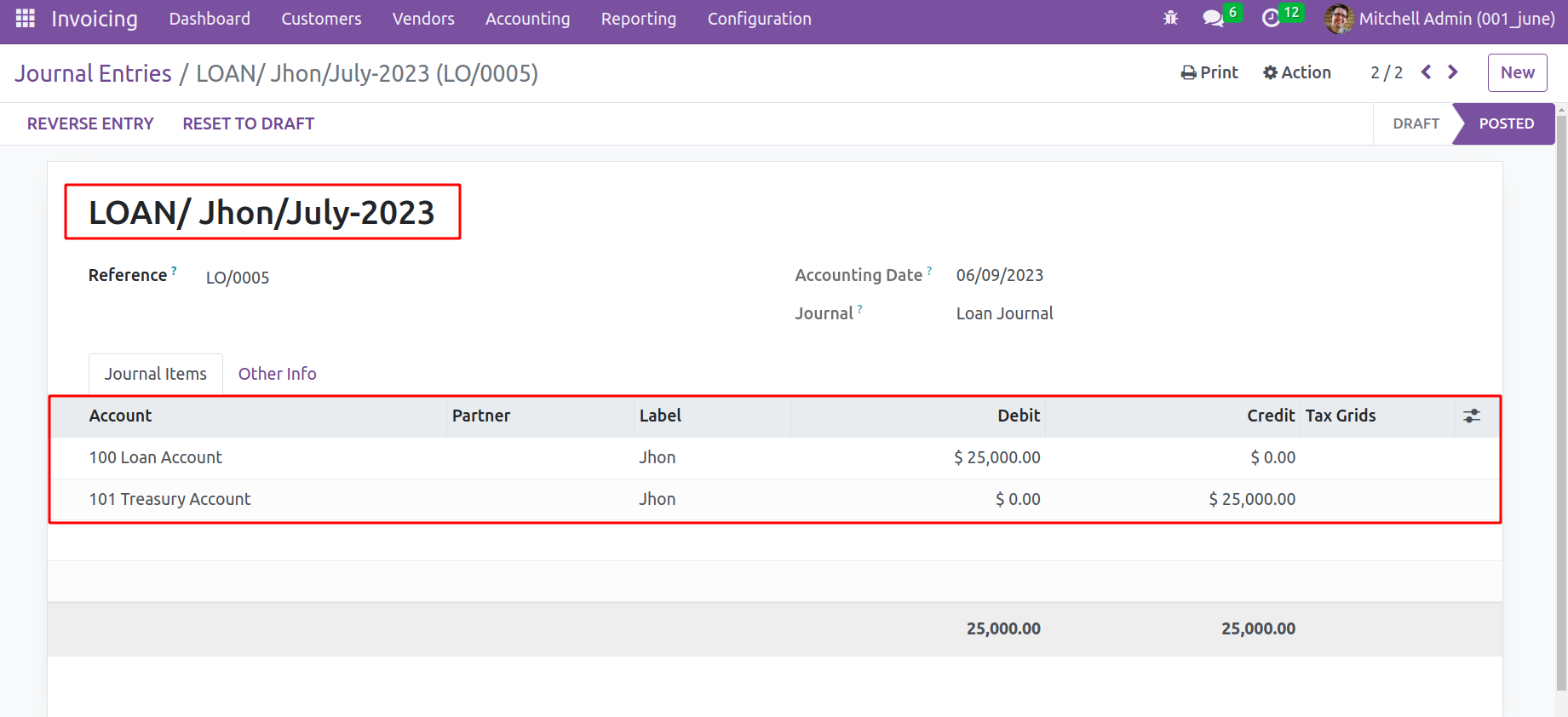

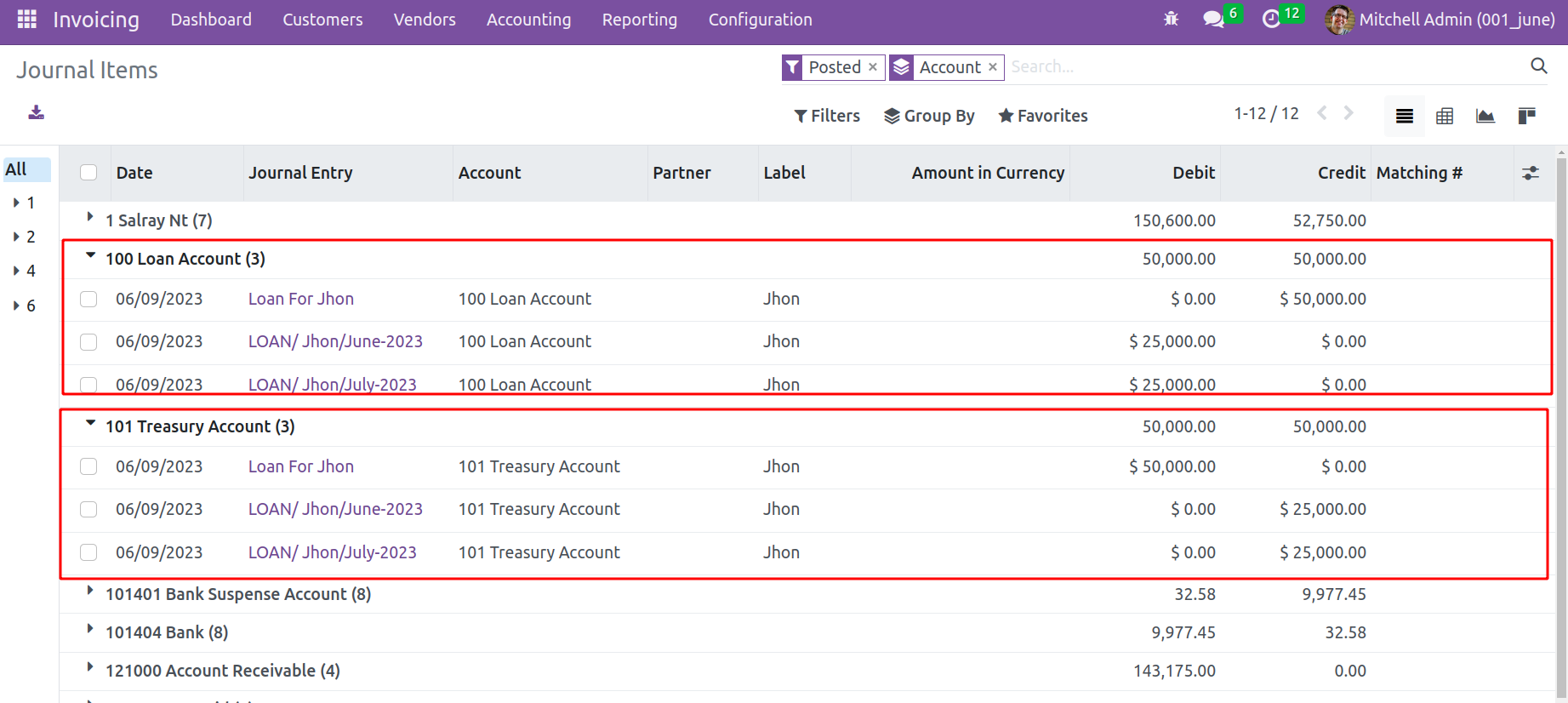

Go to the Invoicing module to review the journal item. Pick the Journal Entry option under the Accounting tab. Two entries that correspond to Loan are displayed. Let's examine them closely.

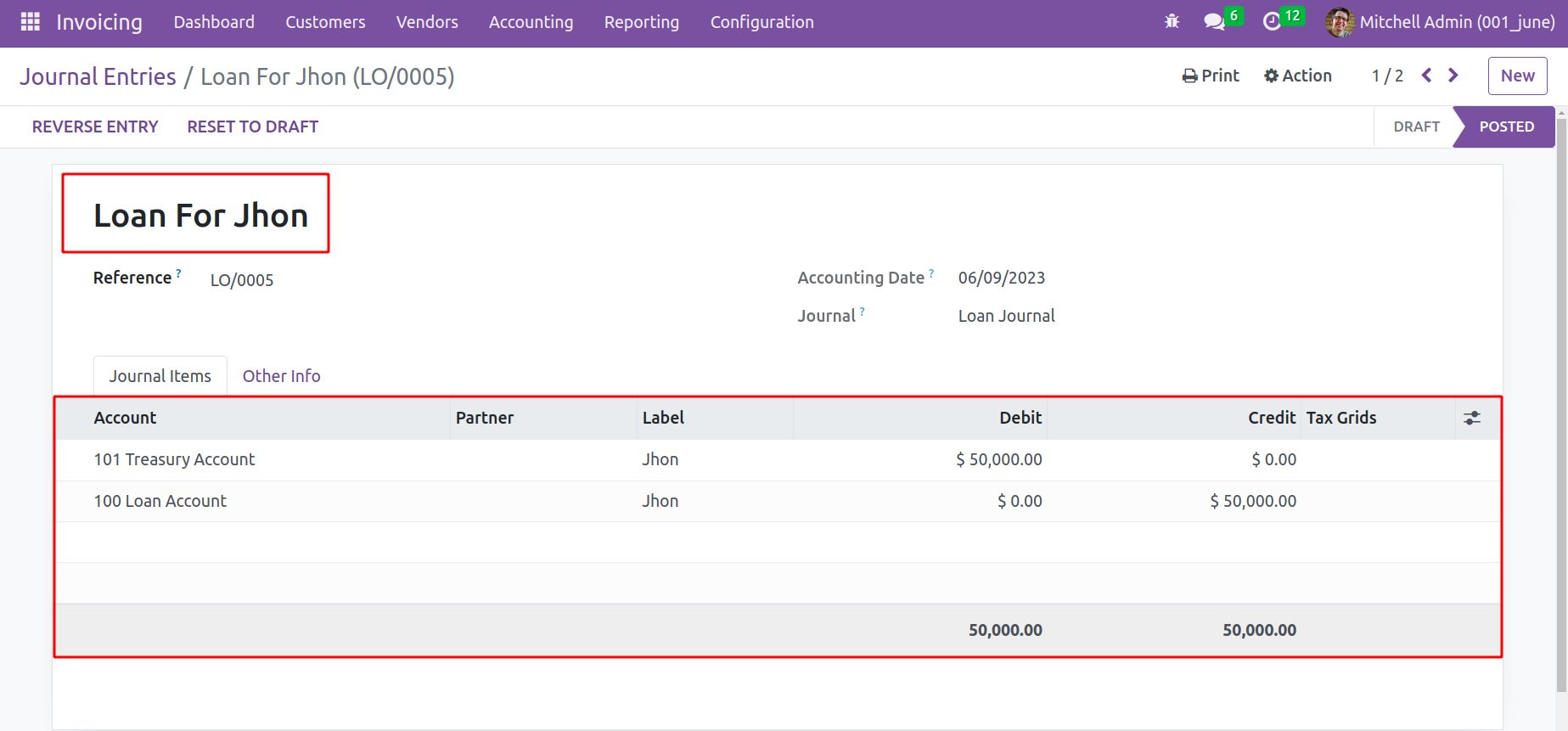

The first entry is created after approving the request, which means this belongs to the loan request. When the employee takes a loan, the Treasury Account is debited because it's the Company Bank Account. The Loan Account is credited because it's an Expense Account.

The second entry was created after the Pay slip was confirmed, which belongs to salary. If the salary to the employee is completed, then the Treasury Account is Credited with the amount and the Loan Account is debited with the amount.

Here the employee has only two installments. If the employee completes the two installments, which means two months’ salary completed then the Account details are the same as given in the screenshot below.

You can build different loan policies with the aid of the OpenHRMS Loan Management module, and the higher authorities can effectively handle them.